- No Products In The Cart

- start shopping

Understanding Slippage in Live Crypto Betting -101313623

Understanding Slippage in Live Crypto Betting

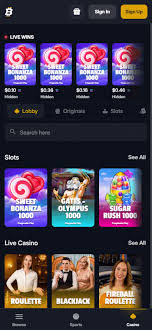

In the rapidly evolving world of cryptocurrency, betting platforms are becoming increasingly popular due to their transparency and accessibility. However, one concept that often confuses bettors is slippage. Slippage in Live Crypto Betting Bitfortune Android is one of the platforms addressing this issue by providing real-time updates and other features. This article explores slippage in live crypto betting, its implications, and tips to mitigate its effects.

What is Slippage?

Slippage refers to the difference between the expected price of a trade and the actual price at which the trade is executed. In the context of live crypto betting, this phenomenon often occurs due to market volatility and speed. When you place a bet on a rapidly changing market, the odds may alter before the transaction is completed, leading to slippage.

The Causes of Slippage

Market Volatility

Cryptocurrencies are well-known for their price fluctuations. During major news events or sudden market shifts, prices can change dramatically within seconds. This volatility means that live bets can become less favorable almost instantly.

Order Size

The size of the bet you place can also influence slippage. A larger order may lead to more significant slippage as it may affect the market price. If you’re betting large amounts, the odds may shift by the time your order is executed.

Liquidity Issues

Liquidity refers to the ease with which an asset can be bought or sold without affecting its price. In times of low liquidity, even minor trades can result in significant price changes, further contributing to slippage.

The Effects of Slippage in Live Betting

Decreased Profitability

One of the most immediate impacts of slippage is decreased profitability. If you anticipated certain odds and the execution resulted in lower odds, your potential profit diminishes. Bettors must constantly adapt their strategies considering the slippage that may occur.

Frustration and Inefficiency

Slippage can also introduce frustration. When you bet with expected outcomes, but the results are far from what you anticipated due to slippage, it can lead to a feeling of inefficiency. Understanding this aspect is crucial for maintaining a positive betting experience.

Ways to Minimize Slippage

Choose the Right Platform

Selecting a betting platform that offers effective mechanisms for minimizing slippage is essential. Platforms like Bitfortune Android focus on providing fast execution times and accurate, real-time odds which can help mitigate slippage.

Place Smaller Bets

When the market is exhibiting high volatility, consider placing smaller bets. This approach can minimize slippage by allowing you to execute multiple smaller orders instead of one large order, potentially reducing the price impact.

Utilize Limit Orders

Using limit orders can also help control slippage. A limit order allows you to set the maximum or minimum price at which you are willing to buy or sell an asset, ensuring you do not execute trades at unfavorable prices.

Monitor Market Conditions

Staying informed about market conditions can provide valuable insights into when slippage may be more likely to occur. During times of high market sensitivity, approach large bets with caution.

Conclusion

Slippage in live crypto betting is an unavoidable reality that can impact the profitability and efficiency of your betting strategies. By understanding its causes and implications, and implementing strategies to minimize its effects, bettors can navigate the complex world of crypto betting more effectively. The key is to remain adaptable and vigilant, leveraging tools and resources that provide better control over the betting process.